What is the one kind of money that is least likely to make you rich? The answer may surprise you: it’s your salary. But if you think about it, it is really, really hard to get rich off of the money your company pays you every two weeks.

When you try to think of high-earners in America, most people think of athletes, movie stars, and entertainers. But if you look at any list of the wealthiest people in the country, there aren’t any of those professions in there. In fact, there aren’t any people who have gotten rich off of their salaries. So how to they do it?

The top 2 ways that people become wealthy in the United States are businesses and real estate. And guess what? For people who aren’t already wealthy, the easiest way to build a business or acquire real estate is with good credit.

Businesses

Those high-powered executives you think of as rich people may indeed take home a large paycheck, but that check is dwarfed by the stock and stock options they receive. In fact, about 2/3 of executives’ total compensation is in stock and stock options. Whether this is trend is good for the overall economy is up for debate, but there’s no escaping the conclusion that ownership is where the real wealth is, whether that’s ownership of a publicly-traded company or your own business.

The #1 road to wealth for the average American is still to start your own business. If you do this, at some point you will need to borrow money to expand. Let’s say you want to buy a $20,000 food trailer to sell your homemade snacks. Where are you going to get that money? For most people, the answer is the Small Business Administration (SBA). SBA loans are the primary means for small businesses to open or expand.

Here’s how the SBA works: you apply for a business loan through a regular bank. If you qualify, the SBA will guarantee that loan for the bank. So if you don’t repay the loan, the bank can get its money from the SBA. The idea is that by having the federal government guarantee small business loans, banks will be more willing to fund businesses, and the entrepreneurial engine of our economy keeps humming along nicely.

For a business you’re just starting, you’re going to have to guarantee the loan personally, too. So just like any other loan, you have to meet certain credit and income requirements, and the loan is reported on your personal credit report. Which means that if your credit is good, you have the possibility of taking out a loan to start your own business. Starting your own business is rewarding on many levels, not the least of which is to make more money than you would be able to at your job, and in the process build an asset that can continue to provide for your family for generations to come.

There’s no way you can achieve that with just your paycheck. And it all starts with having good credit.

Real Estate

The second way to build lasting wealth in America is through real estate. Most people have heard before that real estate accounts for more millionaires than any other investment. And if you talk to your parents, they will tell you that their home was the best investment they ever made.

First of all, there’s a good chance you’re going to want to own your own home some day. In that case, your choices are either save up enough cash to pay for the whole thing, or take out a mortgage to finance the purchase out over 30 years. If your credit sucks, you’re going to get a terrible rate–if you’re even approved for the loan. Over the course of a 30-year mortgage, having bad credit can double the price you end up paying for the home. It’s a huge waste of money, and will set your other financial goal way back. So good credit is a must.

Buying your own home and paying down the debt while enjoying 30 years of appreciation is a great way to build wealth. And beyond that, you may decide you want to invest in real estate on a more serious level by flipping houses, buying rental properties, or whatever strategy you like (no particular endorsement of any of those strategies). Guess what? You’ll need good credit for that, too.

This is what I watched my dad do. When he wanted to buy his first rental property, he got instantly approved for a loan at a fantastic rate because he had near-perfect credit. A couple of years later, he found another attractive property and got a loan for that purchase, too. Then he bought four more, and eventually ended up with a large portfolio of properties (some of which are paid off) that generate income for him and my mom in retirement. Those properties are going up in value over time, and that will allow him to expand his holdings as he chooses, with or without the bank. He’s at the point now where he doesn’t necessarily have to take out a loan.

It certainly takes some skill to do this, but if your credit sucks, you have no chance of even trying. Good credit greases the skids on a relatively easy path to wealth.

The Ladder: How to Get There From Zero

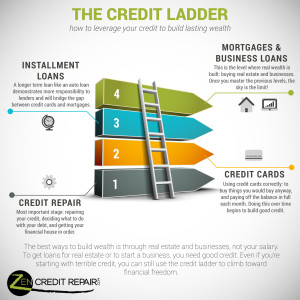

I coined the term “The Credit Ladder” to describe my own journey from rock bottom, horrible credit to great credit that was high enough for me to get my first business loan. I started out in the mid-400s, with no active credit cards (several had been closed and charged off), a lot of debt, and no way to get anything positive on my credit report.

So I started from a full stop. With no way to get a credit card or loan that would start reporting and actually improve my credit, I was stuck. That’s when I started researching credit repair, which is the first step on the Credit Ladder.

Step 1: Credit Repair

Credit Repair means dealing with the past; it is paying off your debts and getting negative entries removed from your credit report. It also encompasses dealing with debt collectors and generally getting your sh*t together. At the end of this process, you’re basically functional again. How to master this level: You have resolved your past financial mistakes (meaning that even if you haven’t paid off your debt in full, you have decided on a plan to do so, or settle, or some other option that resolves this). You are on top of your finances, and you know exactly where you stand with your creditors. This is what I cover in my 5-Day Credit Repair Course. At this point, you have breathing room. You have clarity on exactly where you stand, where you’re going, and how to get there. Step 1, Credit Repair, is the most important step. It is the foundation on which all the rest depends. If you have a shoddy foundation (i. e., if you try to take on more debt before you can handle it), the entire structure will collapse, and you’ll be right back where you started–only with bigger debts.

Step 2: Credit Cards

Once you’ve gotten your financial house back in order, you can build on that foundation. The next step on the credit ladder is to get a credit card. Depending on what is still showing up on your credit report, you may have to start with a secured card with a low credit limit. A secured card means you have to put down a deposit, which becomes your credit limit. For example, you send the credit card company a check for $100, and they send you a credit card with a $100 limit. If you close the account, they send you back your $100.

Get one of these cards, put a small recurring expense on it every month (like a $8.99/month Netflix subscription or something), and then set up an automatic monthly payment from your checking account. That way, you’ll never miss a payment, and you can just sit back and watch that payment go onto your credit report every month. In a few months, your credit scores will start to go up. After 6 months to a year, you’ll be able to get an unsecured credit card, which will be even better for your credit. Repeat the process.

How to master this level: The way to manage your credit cards is to use them only to buy things you would buy anyway, and pay the balance in full every month. If you start carrying a revolving balance and accumulating debt, you have failed. You need to get out of debt completely and use the credit cards as directed above.

Step 3: Installment Loan

There are a few kinds of installment loans, but the best kind for most people is an auto loan, since you need a car anyway. However, you shouldn’t buy a car you don’t need just to have the loan. There are a couple of other options: credit unions will sometimes make you a personal loan. If they will, put the cash in an account and don’t touch it. This requires a high level of self-control. It’s also costing you money in interest. That’s why I really recommend just waiting until you need a new car (or some other larger expense that makes sense to finance–but not routine consumption like furniture, televisions, electronics, etc.). Be patient.

An installment loan is a longer term loan, and therefore requires a higher level of conscientiousness and self-discipline. When a loan officer sees that you have made regular, on-time payments on an installment for several years, he will be more likely to extend you credit for a mortgage or small business loan. On the other hand, if you’ve never had anything other than a credit card, it’s a harder sell. Some people skip this step (especially if they’ve never really had credit/debt payments and defaulted on a loan); however, if you’re starting from zero, like I did, this is an important intermediate step.

How to master this level: Take out an auto loan you can afford. Set up automatic monthly payments from a checking account you use for that purpose. Never miss a payment. As that payment history grows on your credit report, your credit will improve. Your credit scores will also improve because of the mix of credit component. And beyond the score, having an installment demonstrates responsibility to lenders.

Step 4: Mortgages and Business Loans

Once your credit has improved to the top tier and you have mastered the previous level, you are ready to climb up to the highest level. At this level, you are getting big, highly leveraged loans. Access to these loans can change the financial future of you and your family–for better or worse. That’s why it’s so important to master the lower levels: if you fall back down from step 2 by defaulting on a credit card, that’s a relatively easy mistake to recover from. If you fail here by defaulting on your mortgage, you could end up in foreclosure and lose your house, in addition to wrecking your credit. But if you’ve developed the level of self-discipline required to master the previous levels, you’re in good shape. And you can use these loans to buy a house, buy a rental property, or start your own business. Not everyone wants to, but climbing the credit ladder gives you the freedom and opportunity to achieve those financial goals.

I made an infographic to give you a visual idea of what these steps up the credit ladder look like. Enjoy!