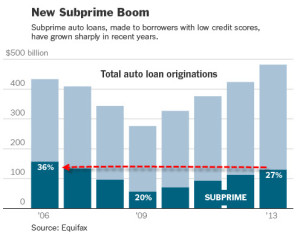

Graph courtesy of ZeroHedge. I’ve blogged about this before. This bubble will burst like all other bubbles do, which will harm the economy. But If you’re responsible enough to take on debt to buy a car, now is a great time to get an auto loan–rates are low, and they’re handing them out like candy on Halloween.

However, if you’re still trying to get your financial house back in order after getting in over your head with debt (like I did during the 2009 crash), do not take on new debt. Better to let this opportunity pass than to undo all the hard work you’ve done getting out of debt.

Before getting a loan, do a hard, realistic self-examination. Can you afford the payments comfortably, now (i. e., not once you get that raise/promotion/winning lottery ticket you’re certain you’re going to get)? If not, don’t get the loan. Buy a crappy car you can pay cash for and accumulate savings while you build/rebuild your credit.