August 7, 2015

August 7, 2015

Seek freedom and become captive of your desires. Seek discipline and find your liberty.

Of all the things that go into a credit score, a discrepancy in mailing address often gets overlooked. It’s important that your address be correct, current, and consistent among all 3 of the major credit bureaus. The Guardian features one woman’s story of what happened due to a lag in public records:

I have no skeletons in my financial cupboard so was surprised to see that in April my Experian rating had dropped from “excellent” to “good” – a massive fall of 80 points. It appeared that Experian had never received details of my address at the time. It explained this was down to the way the local authority updated its electoral roll.

There’s a bit of conventional wisdom floating around that each of us is the average of his five closest friends. The point, I suppose, is that we are influenced by those we spend time with. Either that, or we choose to associate with those most like us. Either way, we are judged by the company we keep, and that is not an altogether unfair way of judging.

Taking this to the extreme, Facebook has announced it has created a new credit scoring model based on friends.

The LA Times with an extensive look at car title loans. Worth a read.

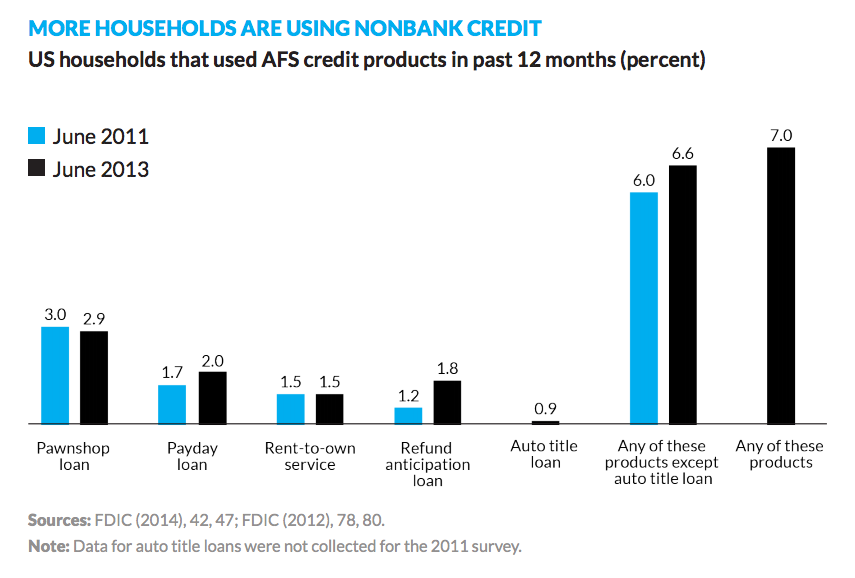

More people using ‘non-bank credit,’ aka payday loans

This article by CityLab includes a survey from 2013 about how many people were using non-bank credit, which is a polite way of saying loans for suckers: payday loans, auto title loans, pawn shops, etc. These are some of the worst things you can do financially for 2 reasons:

Experian released a report on auto loans today. Here are the high points:

- The average credit score for a new vehicle loan dropped slightly, going from 714 in Q1 2014 to 713 in Q1 2015. The average used vehicle score moved slightly higher, from 641 in Q1 2014 to 643 in Q1 2015.

- The average used vehicle loan was $18,213 in Q4 2015, up from $17,927 in Q4 2014.

- The average interest rate for new vehicles was 4.71 percent in Q1 2015, up from 4.54 percent in Q1 2014. Similarly, the average interest rate for used vehicles increased from 9.01 percent in Q1 2014 to 9.17 percent in Q1 2015.

So interest rates have inched up, along with car prices. Elsewhere in the report, they mention that the length of loans is increasing as well. Some people are even taking out 84 month (!) loans for used cars.

The class of 2015 is reaching new heights, though perhaps not the way it had hoped.

College graduates this year are leaving school as the most indebted class ever, a title they’ll hold exclusively for all of about 12 months if current trends hold.

The average class of 2015 graduate with student-loan debt will have to pay back a little more than $35,000, according to an analysis of government data by Mark Kantrowitz, publisher at Edvisors, a group of websites about planning and paying for college. Even adjusted for inflation, that’s still more than twice the amount borrowers had to pay back two decades earlier.

This will not end well. Do not take out a student loan. If you have one already, pay it off as quickly as possible.

From CNN Money:

Job seekers in New York City can now rest assured that their credit history won’t impact their employment prospects. The New York City Council passed legislation that bans most employers from discriminating against job applicants and current workers based on credit history.

This is an interesting development for a few reasons. First, the original intent of credit scoring was to identify a borrower’s chances of defaulting on the loan. Under the law, companies were really only supposed to be able to check your credit score for the purpose of extending you credit (i. e. loaning you money). Now of course, credit checks are used for everything from apartment leases to job applications.

Here’s 7 things you should do with your finances before you’re 25. Spoiler alert: save for retirement, avoid/eliminate debt, and always seek clarity.