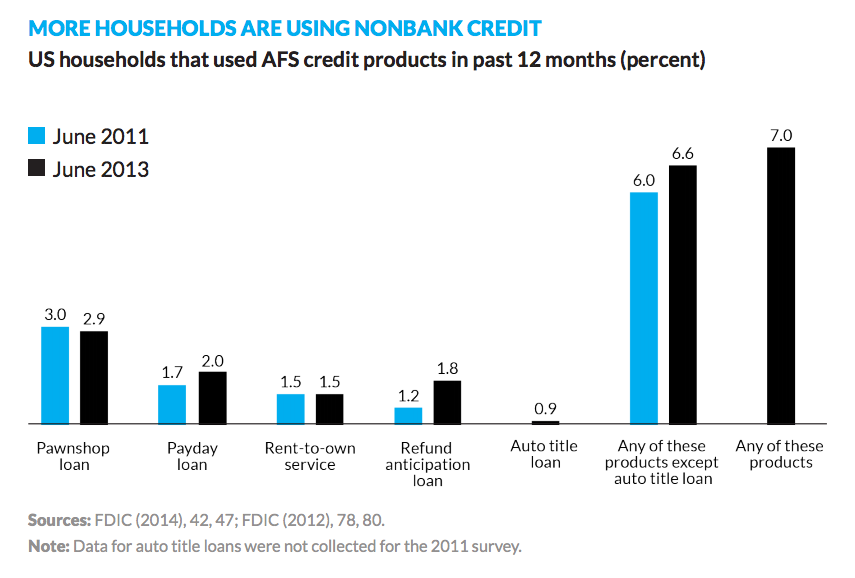

More people using ‘non-bank credit,’ aka payday loans

This article by CityLab includes a survey from 2013 about how many people were using non-bank credit, which is a polite way of saying loans for suckers: payday loans, auto title loans, pawn shops, etc. These are some of the worst things you can do financially for 2 reasons:

- First, the rates are astronomically high. According to research, anywhere from 391% to 521% for payday loans. That means if you borrow $100 for a year, you will end up paying back $491 to $621 total. If you are so strapped for cash that you can’t come up with a given amount of cash, what makes you think that you’ll be able to come up with even more before the interest spirals out of control and causes you to owe many times what you originally borrowed? Oh, that’s right–wishful thinking. News flash: your next big break isn’t right around the corner. You need to get your financial house in order now, and that starts with not doing stupid sh!t like taking out payday loans. Sorry to be harsh, but I’d rather hurt your feelings than see you be broke for the rest of your life.

- Taking out payday loans can hurt your credit. They show up on your credit report just like a car loan, complete with payment history. So if you can’t pay that $50 interest payment for the $100 you borrowed on time, you could destroy years of on-time payments and cause your credit score to tank. Also, just having an entry on your credit reports from a “personal finance company,” which is what sucker loans are called by the credit bureaus, will cause lenders to view you with suspicion. If you don’t have your sh!t together enough to not be running down to the pawn shop every week just to pay your cellphone bill, why would anyone in their right mind want to loan you money for a car or house?

Do not take out one of these sucker loans, ever. Under any circumstances. You are literally better off begging on the corner for spare change.